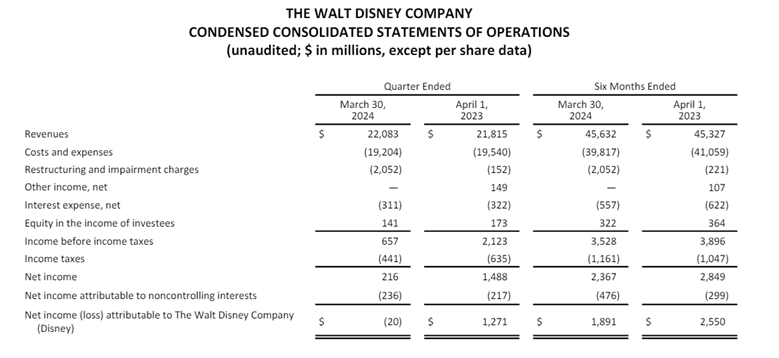

The Walt Disney Company posted a net income loss of $20 million in the second quarter of fiscal year 2024, which began Sept. 30, 2023, according to the latest company data.

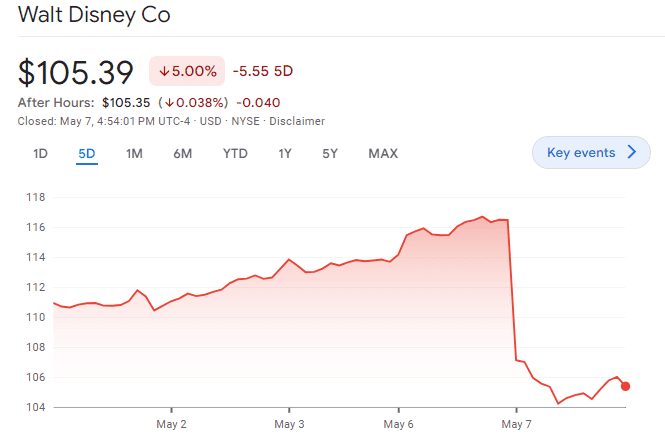

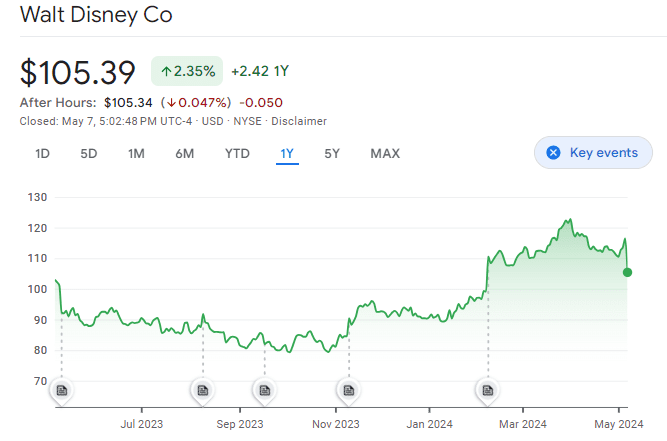

Overall, revenue missed investor expectations, and so the $193 billion market cap company’s stock took a 9.5 percent hit in day trading, falling from $116.90 per share on May 6 to $105.70 on May 7 as trading closed.

But so what? Is this, “get woke, go broke” or simply a “sell the news” moment? Here are some sobering factors to consider:

1) Disney+ and Hulu streaming combined finally went profitable right on schedule in 2024. (ESPN+ is still in the red, though, but the company said that would go in the black by the end of the fiscal year.)

2) Despite commercial bombs at the box office and boycotts in 2023, the company maintained profitability throughout last year, too, generating $2.3 billion in net income. Any losses from Disney Entertainment — Disney appeared to have lost anywhere between $806 million to $831 million on their movies in the 2023 calendar year when theater box office cuts are considered with bomb after bomb — were more than offset by gains by Disney Experiences, which runs the parks.

3) Net income was at a loss in the second quarter at $20 million; but that came atop a $1.9 billion profit in the first quarter. That puts the company at $1.89 billion so far for the fiscal year. In fact, the only year in recent history that showed negative net income was a $2.8 billion loss in 2020 when the parks, cruises and movie theaters were closed for Covid. Otherwise, it’s pretty much always been in the black in modern history. It’s hard for this company to lose money!

RELATED: Johnny Depp Slams Hollywood Studios and Disney While Plotting His Acting Comeback

4) Yes, the stock took a hit in a single day’s trading, and while that might continue for a little while in light of the news, it is worth noting the stock is still actually up 32.7 percent from its Oct. 2023 low of $79.33.

The stock itself actually peaked at about $122 most recently on April 2 — which was up 53.8 percent at the time from the prior low — and so the profit-taking on the stock during this most recent period has been ongoing for more than a month now. Again, that could continue for some time, but watch for an eventual bounce back. Suffice to say, if you bought at the low, you actually did pretty good.

Looking forward, Disney CEO Bob Iger also announced that the company would be lowering the output from its entertainment division after years of flooding the market, with the announcement that Marvel Studios would reduce its output to two to three movies a year and just two streaming shows a year.

“We’re slowly going to decrease volume and go to probably about two TV series a year instead of what had become four and reduce our film output from maybe four a year to two, or a maximum of three,” Iger said in the company’s quarterly call with investors.

Which, actually makes a bit of sense. In their failed bid to gain seats on the Board of Directors of Disney, Trian Fund Management’s Nelson Peltz and former Disney Senior Executive Vice President and Chief Financial Officer James Rasulo said the company needed several reforms including improving the quality and profitability of the movies being produced by Disney, and had promised to “[i]mprov[e] the output and economics of our film studios”.

Despite Peltz and Rasulo’s being rejected for seats on the board, Iger now appears to be taking their advice anyway.

RELATED: Woke Disney makes Snow White Characters Trans at Disney World Park

In a statement after losing the bid for board seats in April, Trian said: “While we are disappointed with the outcome of this proxy contest, Trian greatly appreciates all of the support and dialogue we have had with Disney stakeholders. We are proud of the impact we have had in refocusing this company on value creation and good governance.”

Trian added, “We will be watching the Company’s performance and be focusing on its continued success.”

A major tell will be the performance of Deadpool & Wolverine, Marvel Studios’ only movie this year, starring Ryan Reynolds and Hugh Jackman and due in theaters July 26. With a reported budget of $250 million — factor an additional $125 million for promotion and advertising — and to break even, it will need to do about $375 million at the box office.

RELATED: Disney and Square Enix’s Kingdom Hearts Getting Closer To A Movie or TV Adaptation

Deadpool 1 did $782.6 million globally and Deadpool 2 did $734 million, on much smaller budgets ($58 million and $110 million, respectively). So far, low costs plus audience retention have been the key to the franchise’s success. This makes the latest offering slightly riskier for Disney.

It should all be easy money. The parks are still very profitable — the company reported revenue growth of 10 percent in Disney Experiences. Disney+ and Hulu finally turned a profit. Their net income would be even greater right now without the drag coming from the glut the entertainment division is putting out there. Therefore, simply reducing output from entertainment, and focusing on previously successful franchises like Deadpool, might help increase profitability going forward — assuming audiences haven’t already tapped out.

Which, if you hate what Disney has been doing, with its distinctly woke messaging in movies and television shows, its Diversity, Equity and Inclusion racial and gender hiring quotas that clearly violate Title VII of the Civil Rights Act’s prohibition on racial and sex discrimination in employment or its opposition in the state of Florida to the common sense Parental Rights in Education Act, this is likely not what you want to hear.

In the end, the House of Mouse may yet endure in spite of itself, but only time will tell.

What do you think of Disney’s financial situation? Leave a comment and let us know.

Robert Romano is a Fandom Pulse contributor and Editor-in-Chief of Comicsgate.org.

NEXT: Cast Members Voice Solidarity With Trans Snow White Evil Queen At Disney World Children’s Banquet

Leave a Reply