81-year-old billionaire and activist investor Nelson Peltz’s bid to get elected to The Walt Disney Company’s board of directors got serious on Jan. 29 as Peltz’ Trian Fund Management — the hedge fund he founded and runs as Chief Executive Officer — filed its proxy statement with the Securities and Exchange Commission (SEC) to have himself and former Disney Senior Executive Vice President and Chief Financial Officer James Rasulo elected to Disney’s board of directors at the next annual shareholders meeting.

Peltz also launched https://restorethemagic.com/ to promote the bid to secure Disney board seats, noting the company’s shareholder return was only 40 percent the past decade versus 208 percent for the S&P 500 and 441 percent for Disney’s self-selected media peers.

Peltz and Trian hold 32.4 million, or 1.77 percent of the 1.8 billion outstanding shares worth about $3 billion — the largest active shareholders — and, if the campaign is successful, would grant Peltz and Rasulo seats on the board.

In their bid to shareholders, Peltz and Rasulo promised several reforms including improving the quality and profitability of the movies being produced by Disney, promising to “[i]mprov[e] the output and economics of our film studios”.

In a recent interview with CNBC on Jan. 18, Peltz noted that more than half of Disney’s 2023 movies at the box office lost money.

After the Disney board rejected his bid to join the board, Peltz told CNBC: “[T]hey said I have no media experience, I don’t claim to have any, but I would tell you, I don’t think they have much media experience. They broke a record this year, you know, that the last five movies in a row were losers.”

Peltz added, “Now, if that comes with media experience, I want a guy who doesn’t have media experience.”

Peltz has got a point. To be certain, of the eight major releases for the year, half of them indeed appear to have lost money once marketing costs — thought to encompass an additional 50 percent of its production budget, according to an analysis by MovieWeb.com’s Gaius Bolling — are factored in.

Additionally, movie theaters collect about half of the box office proceeds, per Bolling, making Disney’s big-budget productions an increasingly risky proposition as audiences continue to shy away from theater excursions. By that metric, seven out of the eight movies lost money.

The Marvels, with a $219.8 million so-called net budget (the United Kingdom had granted a $55 million subsidy to cover part of its $274 million budget), swells to $302 million once likely marketing costs are included but only netted $206 million at the box office globally, according to Box Office Mojo, the worst performance by a Marvel Studios movie ever.

But Disney only keeps half of that after the theaters take their cut, and so The Marvels likely lost about $96 million.

Indiana Jones and the Dial of Destiny, with a $295 million production budget and a total likely $445 million once marketing is included, only grossed $383.9 million globally.

After theaters take their half, Indy likely lost Disney about $253 million.

Haunted Mansion cost $150 million to make and a likely total $225 million when marketing is included but only netted $117 million globally.

Once theaters take their half, that works out to a $166.5 million likely loss for Haunted Mansion.

Wish cost somewhere between $175 million to $200 million to make, with a total likely budget of around $275 million to $300 million when marketing is included, but only netted $239.8 million globally.

After the theater cut, that’s another likely loss of $155 million to $180 million for Wish.

Even the awfully titled Ant-Man and Wasp: Quantumania, with a $200 million production budget and likely $300 million total budget once marketing is factored in, and netted $476.1 million globally, still appears to be a loser.

Once theaters take their cut, that’s another $62 million lost for Ant-Man and Wasp: Quantumania.

Also, the live-action The Little Mermaid, which cost $240 million production-wise but likely $360 million when marketing is included, generated $569.6 million.

But because theaters keep half that, The Little Mermaid actually appears to have lost about $75 million.

Elemental cost $200 million to make and likely $300 million once marketing is included, and grossed $496.4 million.

And yet, with theaters taking half, Disney likely lost about $51.8 million on Elemental.

The only movie to turn an apparent profit outright was Guardians of the Galaxy: Vol. 3, which cost $250 million to make and a likely $370 million when marketing is included, and grossed $845.5 million globally.

The theaters took half, and so Guardians of the Galaxy: Vol. 3 earned a meager $52.75 million overall.

All told, once likely marketing and theater hauls are considered, Disney may have lost anywhere between $806 million to $831 million on their movies in the 2023 calendar year — mostly because the movies being made seem to simply cost too much to make, given the likely market return.

All of which underscores Peltz’s principal point that Disney needs to “[i]mprov[e] the output and economics of our film studios…” Why are the films so damned expensive?

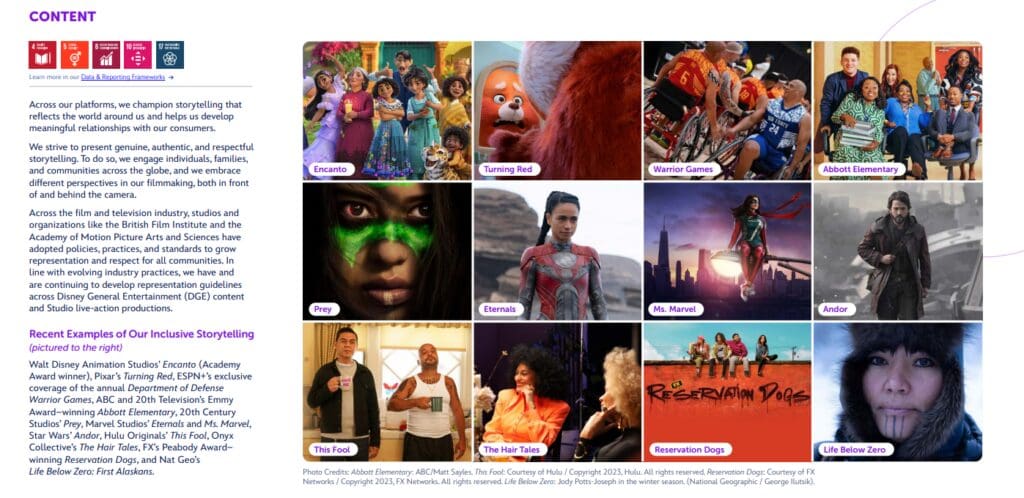

Another factor, of course, is Disney’s ever-present commitment to Diversity, Equity, and Inclusion (DEI) in its pitches to investors, most recently in its 2022 Corporate Social Responsibility report, which touted movies like The Eternals and streaming shows like Ms. Marvel — each commercial bombs in their own rights — as “Recent Examples of Our Inclusive Storytelling.”

Adding to the company’s woes, the Disney Plus streaming service still is not profitable, but the company is promising that it might finally change at the end of 2024. We’ll see. In his bid, Peltz promises to “[t]arget and achieve Netflix-like … margins of 15-20% by FY 2027” for the company’s streaming platform. That is, if Disney would just listen to him.

But even with some losses in the entertainment division, Disney is still a massive company with other profitable lines, including theme parks, and generated a net income of $2.3 billion in fiscal year 2023, which ended Sept. 30, 2023.

Indeed, the company is so large and with such market share in entertainment, theme parks, cruises, and the like — still a $178.8 billion market cap despite performing below its peers on the S&P 500 in 2023 — it has turned a profit using the net income metric every year on record except 2020, when the parks were largely closed due to Covid economic lockdowns, and it posted a $2.8 billion loss to net income.

In other words, as long as the parks and cruises remain open, a massive company like Disney can afford to subsidize its propaganda.

At 81 years old, just as old as Joe Biden, one might be skeptical that Nelson Peltz’s bid could truly make a difference — the company already barred him from becoming a board member last year but also offered to make him a so-called “board observer,” which he rejected — but it is still a good idea.

Now it is up to a vote of the company’s shareholders at the next annual meeting of shareholders, which typically takes place in March or April.

What it does show is that bids like Peltz’ to buy into Disney or Elon Musk’s to take over Twitter in 2022, rebranding it as X in a bid to curtail U.S. government censorship on the platform, might be the only way to overturn some of the social engineering that has been occurring in U.S. corporations. At the end of the day, who owns these massive companies might be what ultimately makes all of the difference.

Robert Romano is a Fandom Pulse contributor and Editor-in-Chief of Comicsgate.org.

What do you think of Nelson Peltz’ bid to get on Disney’s board? Can he save the company? Leave a comment and let us know.

I have a Feeling Disney is betting on the Wrong Horse here.

Sure, after he takes over Disney and kicks out all the diversity hires, wannabe activists and nepotism numpties, he’ll be left with an empty shell of a company with no skill or talent left, and a ruined reputation. Good luck fixing that shit up. lol